Untangling the Financial Beasts Within Your Business!

Let's face it, bookkeeping can feel like wrangling a menagerie of mythical financial beasts. Debits and credits loom like ferocious griffins, receipts flutter like mischievous fairies, and bank statements snarl like territorial dragons. Fear not, intrepid entrepreneur! You are not alone in this financial jungle.This blog is your guide to becoming a Bookkeeper Whisperer. We'll equip you with the knowledge and tools to tame these financial beasts and transform them into loyal companions on your path to business success.

From Griffins to Gentle Giants: Demystifying Debits and Credits

Imagine debits and credits as yin and yang, two sides of the same financial coin. Debits represent the outflow of resources, like the mighty griffin taking flight with your expenses. Credits signify the inflow, like a majestic griffin returning with treasures (your income). By understanding their dance, you'll gain a clear picture of your business's financial health.

Taming the Receipt Fairies: Conquering the Chaos

Receipts, those pesky, papery sprites, can easily multiply and create a bookkeeping nightmare. Fight back! Utilize digital tools like receipt scanners or bookkeeping apps. These will banish the chaos and organize your receipts neatly, saving you time and headaches.

Befriending the Bank Statement Dragons: Understanding Your Financial Territory

Bank statements, once intimidating beasts, can become valuable allies. Learn to decipher their language. Understand debits and credits in your bank statements, categorize transactions effectively, and reconcile them regularly. This will empower you to track your cash flow and identify any discrepancies lurking in your financial territory.

Beyond the Beasts: Unveiling the Bookkeeping Magic

Bookkeeping isn't just about taming mythical creatures. It's about unlocking the magic within your financial data. By analyzing trends, identifying areas for improvement, and generating insightful reports, you'll gain the power to make informed business decisions.

Here are 3 top Bookkeeping tips for 2024

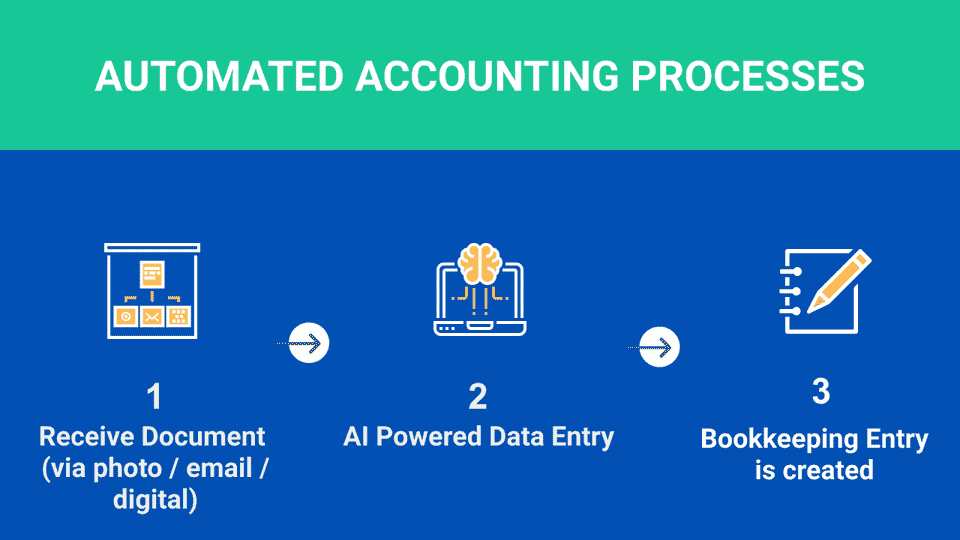

1. Embrace technology and automation: In 2024, there are more bookkeeping software options than ever before. Cloud-based accounting solutions can automate many tedious tasks like data entry, reconciliation, and generating reports. This frees you up to focus on analyzing your financial data and making informed business decisions.

2. Prioritize regular reconciliation: Regularly reconciling your accounts ensures your books are accurate and up-to-date. This means matching your bank statements and credit card transactions with what's recorded in your accounting software. Catching discrepancies early helps prevent errors and makes tax time smoother.

3. Leverage automation for repetitive tasks: Many accounting software programs allow you to automate recurring transactions. This eliminates the risk of manual errors and saves you significant time. Set up automatic entries for things like rent, salaries, and subscriptions.

Is Your Bookkeeping a Mess?

Is Your Bookkeeping a Mess? Take Control Today! Running a business is exciting, but keeping on top of the finances can feel overwhelming. Between invoices, receipts, and taxes, it's easy to let your bookkeeping turn into a cluttered mess. But fear not! You don't need a degree in accounting to have organized finances. Here are some signs it might be time to clean up your bookkeeping act, and some tips to get you started:

- The Paper Avalanche: Drowning in a sea of receipts and invoices? This is a classic sign of bookkeeping chaos.

- The Mystery Money Pit: Do you ever feel like your money disappears into a black hole? Without clear records, it's hard to track your income and expenses.

- Tax Time Terror: Does the thought of tax season send shivers down your spine? Scrambling to find receipts at the last minute is no fun.

- Declutter Your Desk: Dedicate some time to sort, categorize, and file your paperwork. Consider digitizing receipts and invoices whenever possible.

- Embrace Online Tools: There are many user-friendly accounting software programs available that can simplify your bookkeeping.

- Schedule Regular Reviews: Set aside a specific time each week or month to review your finances. This will help you catch errors and stay on top of your bills.

Navigating the Maze: Federal Income Tax Deadlines for Individuals and 1099 Recipients

Navigating the Maze: Federal Income Tax Deadlines for Individuals and 1099 Recipients

Tax season. Just the mention of it can send shivers down the spines of even the most organized individuals. But fear not! By understanding the key federal income tax deadlines, you can stay ahead of the curve and avoid last-minute scrambling. This blog post will delve into the crucial dates for both personal and 1099 filers, ensuring you meet your filing obligations smoothly.Personal Filers:

- April 15, 2024: This is the standard due date for filing your 2023 federal income tax return, unless you fall under specific exceptions. Remember, this year it falls on a Monday.

- October 15, 2024: If you need more time to prepare your return, you can file for a six-month extension using Form 4868. This extension grants you an additional six months to file, pushing your deadline to October 15th. However, it's important to note that this extension only applies to filing your return, not paying any taxes owed.

- Estimated Tax Payments: Throughout the year, individuals with income not subject to withholding might need to make estimated tax payments. These payments prevent a large tax bill surprise come April. The due dates for these payments are typically April 15th, June 15th, September 15th, and January 15th of the following year.

- February 28, 2025 (Paper) / March 31, 2025 (Electronic): If you're a business or self-employed individual, this is the deadline to file Form 1099-MISC to report payments made to independent contractors in the previous year. There are different types of Form 1099 used for different income categories, so be sure to consult the IRS guidelines for specific requirements.

- January 31, 2025: This is the deadline to furnish Form 1099-MISC to the individual or business you made the payment to. Make sure they receive their copy before this date to avoid penalties.

- Stay Organized: Gather all your tax documents, such as W-2s, 1099s, and receipts, as soon as you receive them. This will make the filing process much smoother.

- Consider Professional Help: If your tax situation is complex, consider seeking help from a tax professional. They can ensure you are claiming all eligible deductions and credits and avoid costly mistakes.

- Stay Informed: The IRS website is a treasure trove of information and resources on tax deadlines, forms, and other relevant topics. Bookmark it and refer to it throughout the year.

Disclaimer: This is for informational purposes only and should not be considered tax advice. Please consult with a qualified tax professional for personalized guidance.

The Role of QuickBooks Cleanup Services

QuickBooks Cleanup Services – a specialized solution designed to declutter and refine your financial data. These services offer: Error Rectification: Seasoned professionals meticulously sift through your records, identifying and rectifying errors to ensure accuracy. Reconciliation and Categorization: Thorough reconciliation ensures accounts are balanced, while strategic categorization aligns your data with your business's unique needs. Enhanced Reporting: Organized and structured data leads to comprehensive reports, empowering informed decision-making. Compliance Assurance: Expert checks ensure your records comply with relevant accounting standards, mitigating compliance risks.

Why Opt for Cleanup Services? Efficiency: Cleanup services save time and effort, swiftly resolving issues that may have been overlooked. Accuracy: By eliminating errors and inconsistencies, these services enhance the reliability of your financial information. Expert Guidance: Professionals not only clean up but also educate on maintaining an organized financial system.

Collaborating for Success

Partnering with reputable services like Shertzer Bookkeeping amplifies the benefits. Their expertise combined with specialized QuickBooks cleanup ensures a holistic approach to optimizing your financial records.

Moving Forward

QuickBooks Cleanup Services aren’t just a one-time fix; they pave the way for ongoing financial health. Regular maintenance ensures your records stay organized and reliable, supporting your business's growth and success.

Conclusion

In a competitive business landscape, the accuracy and organization of financial records are non-negotiable. QuickBooks Cleanup Services, complemented by expert guidance and collaboration, offer a clear pathway to untangle the complexities, enabling businesses to thrive with confidence.

Consider the transformational power of QuickBooks Cleanup Services – a small investment for significant long-term benefits in your business's financial management. Get Help Now!

Why Opt for Cleanup Services? Efficiency: Cleanup services save time and effort, swiftly resolving issues that may have been overlooked. Accuracy: By eliminating errors and inconsistencies, these services enhance the reliability of your financial information. Expert Guidance: Professionals not only clean up but also educate on maintaining an organized financial system.

Collaborating for Success

Partnering with reputable services like Shertzer Bookkeeping amplifies the benefits. Their expertise combined with specialized QuickBooks cleanup ensures a holistic approach to optimizing your financial records.

Moving Forward

QuickBooks Cleanup Services aren’t just a one-time fix; they pave the way for ongoing financial health. Regular maintenance ensures your records stay organized and reliable, supporting your business's growth and success.

Conclusion

In a competitive business landscape, the accuracy and organization of financial records are non-negotiable. QuickBooks Cleanup Services, complemented by expert guidance and collaboration, offer a clear pathway to untangle the complexities, enabling businesses to thrive with confidence.

Consider the transformational power of QuickBooks Cleanup Services – a small investment for significant long-term benefits in your business's financial management. Get Help Now!

Tackling 2024 Tax Season: A Comprehensive Guide

With tax season just around the corner, now is the time to make sure your business’s financial materials are in order to ensure an accurate and timely tax filing experience.

Tax season may not be as exciting as launching a new product or landing a big client; however, it is a necessary and important part of every business owner’s journey. With planning and preparation, you can streamline the tax filing process, minimize your stress, and maximize all your tax benefits. So, grab your laptop and let us walk you through this comprehensive guide to help you get your business tax season-ready.

1. Research the Latest Tax Changes

Rarely are two tax seasons exactly alike. Most years bring changes in tax law, fluctuations in your business that affect taxes, or the development of new tax-related technologies. We recommend that you keep yourself up-to-date with tax trends because it will help you and your business better navigate the challenges of tax season and make well-informed financial decisions moving forward.

2. Organize Your Past Financial Records

It is important to have all your financial documentation organized in advance so that you reduce the chances of potential error when filing your taxes. This is also invaluable to review the financial state of your business. Be sure to have the following documents on hand:

Analyzing your financial records and statements to make sure they are accurate is critical during tax season. This will also allow you to identify areas within your business that are strengths and weaknesses.

Identifying the tax credits and deductions for which your business is eligible will allow you to reduce your tax liability. Some common deductions include:

Some commonly used IRS tax forms include:

While some individuals may prefer to handle their taxes themselves, speaking with an accountant or tax advisor can provide you with much-needed expertise and peace of mind – not to mention making sure you receive all the tax deductions and credits to which you are entitled. Get help from a professional

7. Utilize Tax Software – QuickBooks

Utilizing bookkeeping software is great way to move on from manual bookkeeping and improve your preparation for tax season. QuickBooks, a popular accounting software for small businesses, allows you to electronically keep track of your financial records and reduce the amount of time you spend on data entry. It is easily accessible online which allows you to manage your finances anywhere with internet connection.

8. Double, Triple Check Your Information

Accuracy is essential to tax preparation. Before submitting, be sure to go back and review all your information carefully. Verify your personal details and calculations.

9. Begin Planning for the Future

It’s never too early to get a jump start on the next year! Think about what worked and didn’t work during the previous tax season. How can you improve? What would you change? These are things to consider in order to make your next tax filing experience even more seamless.

A proactive approach to tax season requires a combination of knowledge, strategic planning, and organization. By leveraging this guide, you will be able to navigate tax season with confidence and set your business up for financial success. At every step in your journey, A professional can help support your needs and help you tackle tax season like a pro!

Tax season may not be as exciting as launching a new product or landing a big client; however, it is a necessary and important part of every business owner’s journey. With planning and preparation, you can streamline the tax filing process, minimize your stress, and maximize all your tax benefits. So, grab your laptop and let us walk you through this comprehensive guide to help you get your business tax season-ready.

1. Research the Latest Tax Changes

Rarely are two tax seasons exactly alike. Most years bring changes in tax law, fluctuations in your business that affect taxes, or the development of new tax-related technologies. We recommend that you keep yourself up-to-date with tax trends because it will help you and your business better navigate the challenges of tax season and make well-informed financial decisions moving forward.

2. Organize Your Past Financial Records

It is important to have all your financial documentation organized in advance so that you reduce the chances of potential error when filing your taxes. This is also invaluable to review the financial state of your business. Be sure to have the following documents on hand:

- Income Statements

- Expense Receipts

- Payroll Records

- Bank Statements

- Mileage Records

- Estimated Tax Payment Records (if applicable)

Analyzing your financial records and statements to make sure they are accurate is critical during tax season. This will also allow you to identify areas within your business that are strengths and weaknesses.

- Profit and Loss Statement: These are statements that provide a summary of your business’s net profit or loss over a specific period of time.

- Balance Sheet: This financial statement provides you with an overview of what your business owns and owes.

Identifying the tax credits and deductions for which your business is eligible will allow you to reduce your tax liability. Some common deductions include:

- Startup Costs: This could include research or technology expenses.

- Business Expenses: This could include internet bills, office supplies, and travel costs.

- Depreciation: This could include equipment or vehicle expenses.

Some commonly used IRS tax forms include:

- Form 1040, U.S. Individual Income Tax Return

- Form 1040-SR, U.S. Tax Return for Seniors

- Form W-2, Wage and Tax Statement

- Form W-4, Employees Withholding Certificate

- Form W-4P, Withholding Certificate for Pension or Annuity Payments

- Form 1099-MISC, Miscellaneous Income

- Form 1099-G, Certain Government Payments

- Form 1099-K, Payment Card and Third-Party Network Transactions

- 1099-INT, Interest Income

- Form 1099-DIV, Dividends and Distributions

- Form 1098-T, Tuition Statement

- Form 1098, Mortgage Interest Statement

- Form 1095-A, Health Insurance Marketplace Statement

While some individuals may prefer to handle their taxes themselves, speaking with an accountant or tax advisor can provide you with much-needed expertise and peace of mind – not to mention making sure you receive all the tax deductions and credits to which you are entitled. Get help from a professional

7. Utilize Tax Software – QuickBooks

Utilizing bookkeeping software is great way to move on from manual bookkeeping and improve your preparation for tax season. QuickBooks, a popular accounting software for small businesses, allows you to electronically keep track of your financial records and reduce the amount of time you spend on data entry. It is easily accessible online which allows you to manage your finances anywhere with internet connection.

8. Double, Triple Check Your Information

Accuracy is essential to tax preparation. Before submitting, be sure to go back and review all your information carefully. Verify your personal details and calculations.

9. Begin Planning for the Future

It’s never too early to get a jump start on the next year! Think about what worked and didn’t work during the previous tax season. How can you improve? What would you change? These are things to consider in order to make your next tax filing experience even more seamless.

A proactive approach to tax season requires a combination of knowledge, strategic planning, and organization. By leveraging this guide, you will be able to navigate tax season with confidence and set your business up for financial success. At every step in your journey, A professional can help support your needs and help you tackle tax season like a pro!

Maximize Your Tax Benefits: End-of-Year Strategies to Consider

"Maximize Your Tax Benefits: End-of-Year Strategies to Consider"

As the year draws to a close, it's the perfect time to assess your financial situation and take advantage of potential tax-saving opportunities. Whether you're a business owner, a freelancer, or an individual taxpayer, implementing smart end-of-year tax strategies can help you optimize your finances and potentially reduce your tax burden. Here are some valuable tips and considerations to make the most of your tax situation before the year ends:

Review Your Financial Records

Start by reviewing your financial records for the year. Look into income statements, expenses, investments, and any deductible expenses. Assessing your financial situation will give you a clear picture of where you stand and enable you to identify potential areas for tax savings.

Maximize Retirement Contributions

Contributing to retirement accounts such as 401(k)s, IRAs, or SEP-IRAs can offer significant tax advantages. Consider maximizing your contributions before the year-end to potentially reduce your taxable income and bolster your retirement savings. Check the contribution limits and deadlines for each type of retirement account.

Harvest Tax Losses or Gains

Evaluate your investment portfolio. Consider selling underperforming investments to offset gains realized earlier in the year, reducing your overall tax liability. Alternatively, if you have investments with substantial gains, you might consider selling them strategically to take advantage of preferential long-term capital gains tax rates.

Utilize Deductions and Credits

Take advantage of available tax deductions and credits. This includes expenses related to education, medical expenses, charitable contributions, and more. Make sure you have documentation to support these deductions and ensure you're maximizing their benefits.

Plan for Estimated Taxes

If you're self-employed or have additional income not subject to withholding, calculate and make estimated tax payments to avoid underpayment penalties. Review your earnings for the year and use the IRS guidelines to estimate your tax liability.

Charitable Giving

Consider making charitable donations before the year-end. Not only does it support causes you care about, but it also provides potential tax deductions. Remember to obtain receipts or acknowledgments for any charitable contributions you make.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

Check the balances in your FSAs and HSAs. For FSAs, spend any remaining funds before they expire at the end of the year. With HSAs, ensure you maximize contributions and consider their triple tax advantage—tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Consult with a Tax Professional

Every individual or business situation is unique. Consider consulting with a tax professional or financial advisor who can provide personalized advice tailored to your specific circumstances. They can offer insights and strategies that you might not have considered, maximizing your tax benefits.

Plan for the Next Year

As you strategize for the end of this year, also start planning for the upcoming year. Consider changes in your financial situation or tax laws that might impact your tax planning for the following year.

By taking proactive steps and being mindful of these end-of-year tax strategies, you can potentially minimize your tax liability and better position yourself for financial success. Make the most of these opportunities to optimize your tax situation and start the new year on the right financial footing.Get more end of year 2023 tax help

As the year draws to a close, it's the perfect time to assess your financial situation and take advantage of potential tax-saving opportunities. Whether you're a business owner, a freelancer, or an individual taxpayer, implementing smart end-of-year tax strategies can help you optimize your finances and potentially reduce your tax burden. Here are some valuable tips and considerations to make the most of your tax situation before the year ends:

Review Your Financial Records

Start by reviewing your financial records for the year. Look into income statements, expenses, investments, and any deductible expenses. Assessing your financial situation will give you a clear picture of where you stand and enable you to identify potential areas for tax savings.

Maximize Retirement Contributions

Contributing to retirement accounts such as 401(k)s, IRAs, or SEP-IRAs can offer significant tax advantages. Consider maximizing your contributions before the year-end to potentially reduce your taxable income and bolster your retirement savings. Check the contribution limits and deadlines for each type of retirement account.

Harvest Tax Losses or Gains

Evaluate your investment portfolio. Consider selling underperforming investments to offset gains realized earlier in the year, reducing your overall tax liability. Alternatively, if you have investments with substantial gains, you might consider selling them strategically to take advantage of preferential long-term capital gains tax rates.

Utilize Deductions and Credits

Take advantage of available tax deductions and credits. This includes expenses related to education, medical expenses, charitable contributions, and more. Make sure you have documentation to support these deductions and ensure you're maximizing their benefits.

Plan for Estimated Taxes

If you're self-employed or have additional income not subject to withholding, calculate and make estimated tax payments to avoid underpayment penalties. Review your earnings for the year and use the IRS guidelines to estimate your tax liability.

Charitable Giving

Consider making charitable donations before the year-end. Not only does it support causes you care about, but it also provides potential tax deductions. Remember to obtain receipts or acknowledgments for any charitable contributions you make.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

Check the balances in your FSAs and HSAs. For FSAs, spend any remaining funds before they expire at the end of the year. With HSAs, ensure you maximize contributions and consider their triple tax advantage—tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Consult with a Tax Professional

Every individual or business situation is unique. Consider consulting with a tax professional or financial advisor who can provide personalized advice tailored to your specific circumstances. They can offer insights and strategies that you might not have considered, maximizing your tax benefits.

Plan for the Next Year

As you strategize for the end of this year, also start planning for the upcoming year. Consider changes in your financial situation or tax laws that might impact your tax planning for the following year.

By taking proactive steps and being mindful of these end-of-year tax strategies, you can potentially minimize your tax liability and better position yourself for financial success. Make the most of these opportunities to optimize your tax situation and start the new year on the right financial footing.Get more end of year 2023 tax help

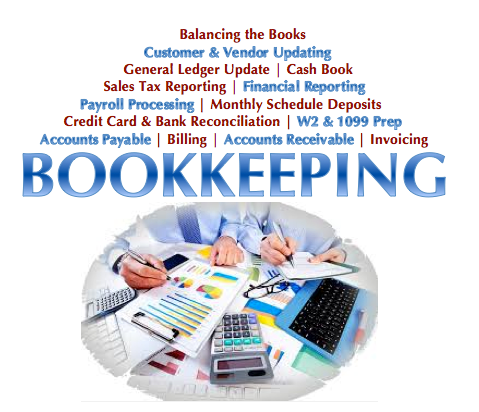

Unraveling the Artistry of Bookkeeping

Introduction: In the world of business, where numbers rule and precision is paramount, bookkeeping stands as the unsung hero. Often relegated to the background, bookkeeping is more than just a meticulous record-keeping process—it's an art that unveils the financial narrative of a company. In this blog post, we'll embark on a journey beyond the ledger, exploring the nuances of bookkeeping that transform it from a mundane task into a captivating art form. The Symphony of Numbers: Imagine bookkeeping as a symphony, with each transaction playing a unique note. The careful arrangement of these notes produces a harmonious financial composition. From debits to credits, every entry contributes to the melody of a company's financial story. Dive into the world of balance sheets and income statements, and witness the creation of a financial masterpiece. The Palette of Categorization: Bookkeeping involves more than just crunching numbers; it's about categorizing transactions with the precision of an artist choosing the right color. Explore the art of categorization, where each expense and income is meticulously placed on the canvas of financial records. Discover how these categories tell a story about the company's financial health and priorities. Time Travel through Financial Statements: Financial statements are the time machines of bookkeeping, allowing us to travel back and forth in the company's financial history. Uncover the art of trend analysis as we decode how financial statements provide insights into a company's growth, setbacks, and evolving financial landscape. It's not just about numbers; it's about understanding the journey they paint. The Dance of Compliance and Regulation: Bookkeeping is not just an artistic expression; it's a dance with compliance and regulation. Delve into the world of GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) as we explore how bookkeepers navigate the intricate choreography of regulatory frameworks. Compliance becomes a dance, and every step matters. Digital Alchemy: Transforming Data into Wisdom: In the age of technology, bookkeeping transcends the physical realm of ledgers and pens. It's about digital alchemy—transforming raw data into meaningful insights. Explore the magic of accounting software, automation, and artificial intelligence that elevate bookkeeping into a futuristic art form, allowing businesses to make informed decisions with unprecedented speed and accuracy.

Conclusion: Bookkeeping, often perceived as a mundane task, is a canvas waiting to be painted with the strokes of financial acumen. It's not just about numbers; it's about the artistry of capturing a company's financial journey. As we unravel the intricacies of bookkeeping, we discover a world where precision meets creativity, and every entry contributes to the symphony of financial success. So, the next time you open the ledger, remember that you're not just crunching numbers; you're crafting a financial masterpiece.

Conclusion: Bookkeeping, often perceived as a mundane task, is a canvas waiting to be painted with the strokes of financial acumen. It's not just about numbers; it's about the artistry of capturing a company's financial journey. As we unravel the intricacies of bookkeeping, we discover a world where precision meets creativity, and every entry contributes to the symphony of financial success. So, the next time you open the ledger, remember that you're not just crunching numbers; you're crafting a financial masterpiece.

Global Accounting Firms Software Market Empowering Financial Professionals | Forecast 2023 to 2030

At a CAGR of 9.2%, the Accounting Firms Software Market is anticipated to increase from USD 14.71 billion in 2023 to USD 29.8 billion in 2030. The market is being pushed by the rising use of cloud-based accounting software, the rising need for efficiency and automation, and the rising compliance standards. A type of software called accounting companies software assists accounting firms in automating and streamlining their accounting procedures. Accounts payable, accounts receivable, payroll, and general ledger are just a few of the duties that it may be utilized for.

The first accounting software solutions were developed in the early 1980s, and the Accounting Firms Software Market has been established for many years. The market has experienced substantial development in recent years, however, as a result of the rising popularity of cloud-based accounting software and the rising need for accounting software that can handle intricate corporate operations. At first, only major accounting companies with the funds to purchase pricey mainframe computers had access to these systems. However, accounting software became available to smaller accounting businesses as technology improved and personal computers became more reasonably priced.

The Key companies profiled in the Accounting Firms Software Market:

The study examines the Accounting Firms Software Market’s competitive landscape and includes data on KPMG, Bench, PwC, Wolters Kluwer, Accountingprose, NSBN, Dixon Hughes Goodman, Ernst & Young (E&Y), Insperience Business Services, Michael Silver & Company, Prime Global, Sikich, Positive Venture Group, AcctTwo, Analytix Solutions, Andersen Tax LLC, Moore Stephens International, Avitus Group, Baker Tilly, Berdon LLP, Block Advisors, Bookkeeping Express, Busch CPA, Cornerstone Solutions, Crowe, D’Amore Consulting, Deloitte, Eide Bailly, EisnerAmper, Expertise & Others.

Global Accounting Firms Software Market Split by Product Type and Applications

This report segments the Accounting Firms Software Market on the basis of Types:

Cloud-Based

Web-Based

On the basis of Application, the Accounting Firms Software Market is segmented into:

Large Enterprises

SMEs

Cloud-based accounting software’s expansion. Accounting businesses do not need to invest in and maintain their own hardware and software infrastructure since cloud-based accounting software is hosted and maintained by a third-party source. Additional benefits of cloud-based accounting software include scalability, accessibility, and security. The linking of accounting programs to other business programs. Enterprise resource planning (ERP) and customer relationship management (CRM) software, for example, are rapidly being connected with modern accounting software systems. Accounting organizations may streamline their processes and increase their productivity thanks to this connectivity. Learn more from Digital Journal

The first accounting software solutions were developed in the early 1980s, and the Accounting Firms Software Market has been established for many years. The market has experienced substantial development in recent years, however, as a result of the rising popularity of cloud-based accounting software and the rising need for accounting software that can handle intricate corporate operations. At first, only major accounting companies with the funds to purchase pricey mainframe computers had access to these systems. However, accounting software became available to smaller accounting businesses as technology improved and personal computers became more reasonably priced.

The Key companies profiled in the Accounting Firms Software Market:

The study examines the Accounting Firms Software Market’s competitive landscape and includes data on KPMG, Bench, PwC, Wolters Kluwer, Accountingprose, NSBN, Dixon Hughes Goodman, Ernst & Young (E&Y), Insperience Business Services, Michael Silver & Company, Prime Global, Sikich, Positive Venture Group, AcctTwo, Analytix Solutions, Andersen Tax LLC, Moore Stephens International, Avitus Group, Baker Tilly, Berdon LLP, Block Advisors, Bookkeeping Express, Busch CPA, Cornerstone Solutions, Crowe, D’Amore Consulting, Deloitte, Eide Bailly, EisnerAmper, Expertise & Others.

Global Accounting Firms Software Market Split by Product Type and Applications

This report segments the Accounting Firms Software Market on the basis of Types:

Cloud-Based

Web-Based

On the basis of Application, the Accounting Firms Software Market is segmented into:

Large Enterprises

SMEs

Cloud-based accounting software’s expansion. Accounting businesses do not need to invest in and maintain their own hardware and software infrastructure since cloud-based accounting software is hosted and maintained by a third-party source. Additional benefits of cloud-based accounting software include scalability, accessibility, and security. The linking of accounting programs to other business programs. Enterprise resource planning (ERP) and customer relationship management (CRM) software, for example, are rapidly being connected with modern accounting software systems. Accounting organizations may streamline their processes and increase their productivity thanks to this connectivity. Learn more from Digital Journal

Good Bookkeeping Provides a Stress-free Tax Season

Tax season: two words that can send shivers down the spines of even the most financially savvy individuals. It's a time of year when receipts, statements, and forms seem to multiply overnight, and the pressure to get everything in order can be overwhelming. However, what if we told you there's a way to breeze through tax season with ease? The secret lies in one fundamental practice: good bookkeeping.

The Foundation of Financial Success

Bookkeeping is the backbone of any successful financial strategy. It involves the meticulous recording, organizing, and tracking of financial transactions, making it a critical element for both individuals and businesses. When done right, it not only provides a clear snapshot of your financial health but also ensures you're prepared come tax season.

Why Good Bookkeeping Matters During Tax Season

1. Accuracy Saves Time and Money

One of the most significant benefits of good bookkeeping is accuracy. When your financial records are in order, it reduces the likelihood of errors on your tax return. This means fewer revisions and less back-and-forth with tax authorities. As a result, you save time and potentially even money on penalties or fines.

2. Maximizing Deductions

Without proper records, you might miss out on eligible deductions. Good bookkeeping ensures that every legitimate expense is accounted for, helping you minimize your tax liability legally.

3. Audit-Proofing Your Finances

Nobody wants to think about an audit, but it's a possibility for anyone. If the tax authorities come knocking, having thorough and well-organized records can make the process much smoother. It demonstrates that you have nothing to hide and that your financial affairs are in order.

4. Peace of Mind

Perhaps the most valuable aspect of good bookkeeping is the peace of mind it provides. Knowing that your financial records are up-to-date and accurate means you can approach tax season with confidence, rather than dread.

Tips for Effective Bookkeeping

Now that we've established the importance of good bookkeeping, let's delve into some practical tips to ensure your financial records are in tip-top shape:

1. Consistency is Key

Make it a habit to record transactions regularly. Whether it's daily, weekly, or monthly, consistency is crucial.

2. Utilize Technology

Consider using accounting software or apps to streamline the process. These tools can automate many aspects of bookkeeping, reducing the potential for human error.

3. Organize Your Documents

Keep physical and digital copies of receipts, statements, and important documents in an organized manner. This will save you time and frustration when you need to retrieve them later.

4. Seek Professional Help When Needed

If you're unsure about certain financial matters, don't hesitate to consult with a professional accountant or bookkeeper. Their expertise can be invaluable, especially when it comes to complex tax regulations.

Conclusion

Good bookkeeping is more than just a financial best practice—it's the key to a stress-free tax season. By maintaining accurate and organized records throughout the year, you set yourself up for success when it comes time to file your taxes. So, make it a priority to invest in your financial well-being through diligent bookkeeping. Your future self will thank you. See why you need a professional it can be complicated

The Foundation of Financial Success

Bookkeeping is the backbone of any successful financial strategy. It involves the meticulous recording, organizing, and tracking of financial transactions, making it a critical element for both individuals and businesses. When done right, it not only provides a clear snapshot of your financial health but also ensures you're prepared come tax season.

Why Good Bookkeeping Matters During Tax Season

1. Accuracy Saves Time and Money

One of the most significant benefits of good bookkeeping is accuracy. When your financial records are in order, it reduces the likelihood of errors on your tax return. This means fewer revisions and less back-and-forth with tax authorities. As a result, you save time and potentially even money on penalties or fines.

2. Maximizing Deductions

Without proper records, you might miss out on eligible deductions. Good bookkeeping ensures that every legitimate expense is accounted for, helping you minimize your tax liability legally.

3. Audit-Proofing Your Finances

Nobody wants to think about an audit, but it's a possibility for anyone. If the tax authorities come knocking, having thorough and well-organized records can make the process much smoother. It demonstrates that you have nothing to hide and that your financial affairs are in order.

4. Peace of Mind

Perhaps the most valuable aspect of good bookkeeping is the peace of mind it provides. Knowing that your financial records are up-to-date and accurate means you can approach tax season with confidence, rather than dread.

Tips for Effective Bookkeeping

Now that we've established the importance of good bookkeeping, let's delve into some practical tips to ensure your financial records are in tip-top shape:

1. Consistency is Key

Make it a habit to record transactions regularly. Whether it's daily, weekly, or monthly, consistency is crucial.

2. Utilize Technology

Consider using accounting software or apps to streamline the process. These tools can automate many aspects of bookkeeping, reducing the potential for human error.

3. Organize Your Documents

Keep physical and digital copies of receipts, statements, and important documents in an organized manner. This will save you time and frustration when you need to retrieve them later.

4. Seek Professional Help When Needed

If you're unsure about certain financial matters, don't hesitate to consult with a professional accountant or bookkeeper. Their expertise can be invaluable, especially when it comes to complex tax regulations.

Conclusion

Good bookkeeping is more than just a financial best practice—it's the key to a stress-free tax season. By maintaining accurate and organized records throughout the year, you set yourself up for success when it comes time to file your taxes. So, make it a priority to invest in your financial well-being through diligent bookkeeping. Your future self will thank you. See why you need a professional it can be complicated

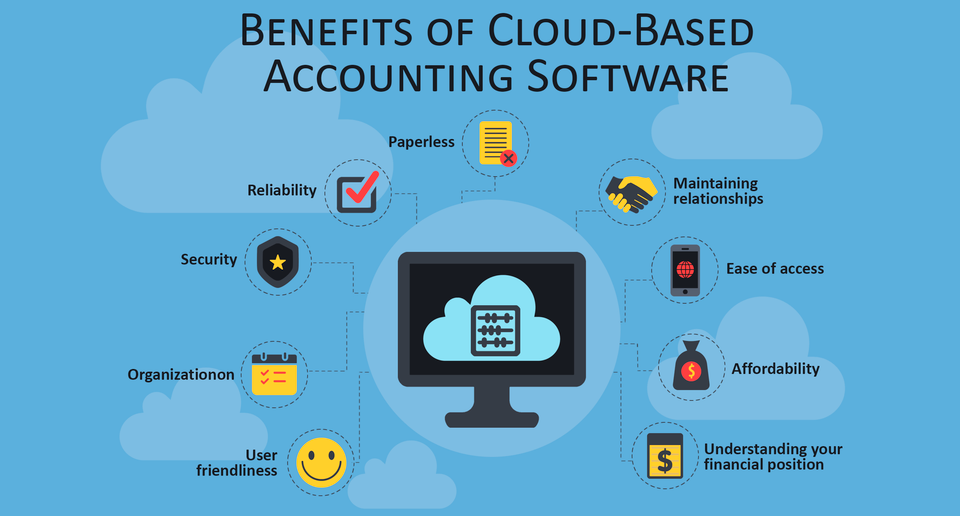

Cloud-Based Bookkeeping

Cloud-based Bookkeeping refers to the practice of using internet-based software and storage solutions to handle a company's financial transactions, record-keeping, and reporting. Instead of relying on traditional desktop accounting software, which is installed on individual computers, cloud-based accounting utilizes online platforms that can be accessed from any device with an internet connection. Accessibility: Users can access their accounting data from anywhere with an internet connection. This allows for real-time collaboration among team members, regardless of their physical location. Security: Cloud-based accounting providers typically have robust security measures in place to protect sensitive financial information. This often includes encryption, multi-factor authentication, and regular security audits. Automatic Updates: With cloud-based accounting software, updates and maintenance are handled by the provider, reducing the need for manual updates and ensuring that users are always using the latest version. Cost-Effective: Cloud-based solutions usually have subscription-based pricing models, which can be more cost-effective for businesses, especially smaller ones, compared to traditional software that requires significant upfront investment. Scalability: Cloud-based accounting solutions can scale with your business. Whether you're a small startup or a large enterprise, you can adjust your subscription and features as needed. Integration: Many cloud-based accounting platforms can integrate with other business software, such as CRM systems, e-commerce platforms, and payroll systems. This can streamline processes and reduce the need for manual data entry. Backup and Recovery: Cloud-based systems often include automatic backup and recovery features, reducing the risk of data loss due to hardware failure or other unforeseen events. Collaboration and Multi-User Access: Multiple users can access and work on the same data simultaneously, which promotes collaboration among team members and advisors. Real-Time Reporting: Because data is updated in real time, businesses can generate up-to-date financial reports and insights, allowing for better decision-making. Reduced IT Overhead: Since the software is hosted on the provider's servers, there's less need for in-house IT infrastructure and support.

Popular cloud-based accounting software options include QuickBooks Online, Xero, Zoho Books, and Wave Accounting, among others. Each platform has its own set of features and pricing plans, so businesses should evaluate their specific needs before choosing a solution.

Overall, cloud-based accounting has become a popular choice for businesses of all sizes due to its flexibility, accessibility, and cost-effectiveness. However, it's important for businesses to choose a reputable provider and implement proper security measures to safeguard their financial data.

Popular cloud-based accounting software options include QuickBooks Online, Xero, Zoho Books, and Wave Accounting, among others. Each platform has its own set of features and pricing plans, so businesses should evaluate their specific needs before choosing a solution.

Overall, cloud-based accounting has become a popular choice for businesses of all sizes due to its flexibility, accessibility, and cost-effectiveness. However, it's important for businesses to choose a reputable provider and implement proper security measures to safeguard their financial data.

Bookkeeping Trends 2023

Automation and Technology Integration:

- Automation tools, including AI-driven software and cloud-based accounting solutions, are likely to continue their growth. They streamline data entry, reconciliation, and reporting tasks, reducing manual work for bookkeepers.

- The shift towards cloud-based accounting software will likely persist. It allows for real-time collaboration, access to data from anywhere, and enhanced security measures.

- With an increase in cyber threats, bookkeepers will continue to prioritize data security. This may involve implementing stronger encryption, multi-factor authentication, and regular security audits.

- Bookkeepers are increasingly viewed as advisors, providing insights and recommendations based on financial data. This trend is likely to continue, with bookkeepers offering more strategic guidance to businesses.

- Companies are placing more emphasis on ESG reporting, which involves tracking and reporting on their environmental, social, and governance performance. This could impact the way bookkeepers handle sustainability-related data.

- Staying up-to-date with changing tax laws and regulatory compliance will always be a crucial aspect of bookkeeping. In 2023, new regulations or changes to existing tax laws might influence bookkeeping practices.

- The trend of remote work, accelerated by the COVID-19 pandemic, may continue. This will require bookkeepers to adapt to virtual collaboration tools and find efficient ways to communicate and share documents.

- AI and machine learning tools are becoming more sophisticated. In bookkeeping, these technologies can help analyze large volumes of data and identify patterns or anomalies more effectively.

- As cryptocurrencies and blockchain technology continue to gain traction, bookkeepers may need to adapt to new ways of recording and reporting financial transactions related to these technologies.

- The accounting and bookkeeping profession will continue to evolve. Bookkeepers may need to invest in continuous education and training to keep up with industry best practices and emerging technologies.